Financial Therapy Texas Blog

Pragmatic Ideas, Virtuous Goals

Financial Goals for the New Year: How to get a jump start planning out your finances for 2026

Setting Financial New Years Resolutions is on the mind of many people this year. Here are some tips of how to successfully implement these goals!

Is Financial Anxiety Hurting Your Relationship?

Financial Anxiety can literally ruin your relationship — fighting about money is one of the most commonly cited reasons for divorce. Early identification of Financial Anxiety can help couples understand and work together to help improve their communication about money.

Holiday Spending: How to stay on budget & keep from being a Scrooge

How can we give generously and stay on budget?

Are Financial Secrets Harming My Relationship? The Financial Infidelity Scale can help

Are Financial Secrets creating distance in your relationship? The Financial Infidelity Scale may help you to find out!

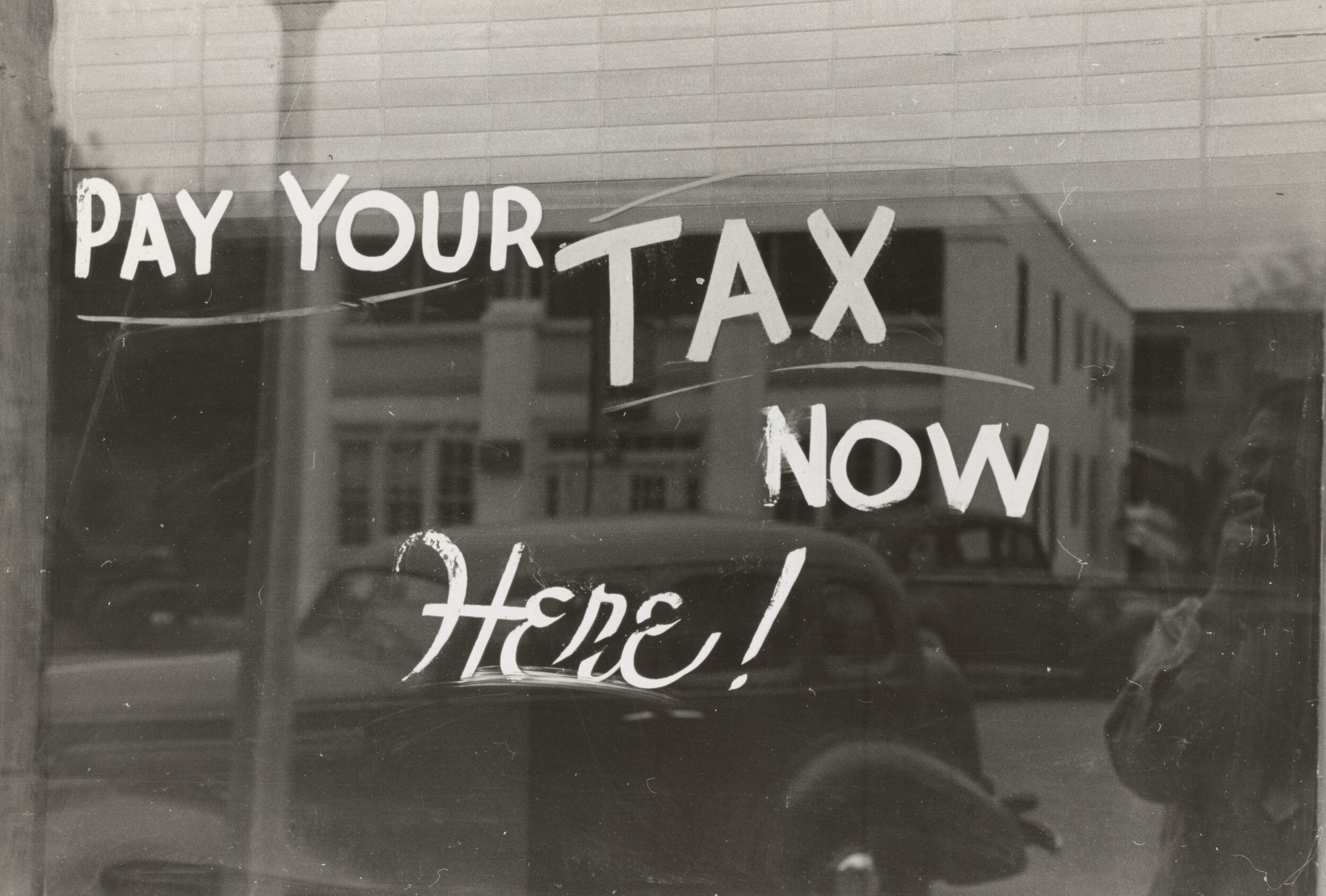

Financial Benefits & Drawbacks of a Frugal MacDoogal Mentality

Like the photo states, the Frugal MacDoogals of the world would rather “Cease the Day” than “Seize the Day”… But is is possible to have safety and live well?

Financial Benefits and Drawbacks of a YOLO/Carpe Diem Mentality

Can we harvest the benefits of the Carpe Diem/YOLO mentality, while avoiding the risks of this carefree lifestyle?

Bringing Up Baby: Discussing financial hopes and fears of becoming parents

Don’t let fear be the guide to discussing the financial side of becoming parents.

What to do when Financial Goals change in your relationship: 3 ways to navigate shifting tides of life

Life happens… things change! But the worst thing you can do is avoid talking about these changes with your partner.

Caring for Caregivers: The financial impact of medical debt

Medical issues can quickly change people's roles in the family, including the financial.

Gambling Addiction: When something fun becomes problematic

Ah, Gambling! Just the word conjures images of smoky casinos, bright lights, and a soundtrack of Sinatra’s “Luck Be A Lady Tonight” playing overhead. While still a way to safely enjoy the thrill of the chase for many, for some, this can quickly become life-shattering.

5 Steps for Getting on the Same Financial Page as Your Parents Age

Putting off money conversations with aging parents can have negative consequences. Here are some steps to help clarify expectations for the whole family.

8 questions to ask about Financial Management Roles in your Relationship

How do you divide up the household Financial Management Roles?

Financial Intimacy: Going beyond “I’ll show you mine if you show me yours”

Being vulnerable about money is actively discouraged in our society. This makes it difficult to open up to loved ones about finances. Taking that risk can open up a whole new level of closeness.

Couples Therapy for Gambling Addiction: Stronger together

Many of the approaches to Gambling Disorder focus on the individual (and can be helpful, but take quite some time). One approach that might be more helpful is Couples Therapy for Gambling.

Couples Financial Therapy: Budgeting that reflects both of your values

Couples Financial Therapy: Budgeting that reflects both of your values. A guide to setting up your budget together.

Online Shopping Addiction Scale — A closer look

Am I a ‘healthy’ shopper … Or am I using my shopping in an addictive way? How the hell can I tell the difference?

This is where scales can be helpful as we assess our need to change our spending behaviors (or not!).

If I Won the Lottery: Using Powerball to articulate hopes for relationship

Whether you’re buying a ticket this time or not, this exercise can help you explore what hopes lie beneath the dream of financial freedom.

Hoarding Disorder: How to know when saving has gone too far

Hoarding Disorder with money: How to know the difference between responsible saving and going too far.

Student Loans & Relationships: How Forbearance ending can improve Financial Intimacy

Student Loan Forbearance ending provides a unique opportunity for couples to work on their relationship by increasing their Financial Intimacy.

The Burden of Breadwinner Guilt: The strain of bringing home the bacon as a woman

In heterosexual relationships, the data of who is the breadwinner has shifted dramatically in the past 40 years — but the cultural norms might not have changed as quickly as the numbers.